2 years ago

Zadaa Closes €4m Series-A

Zadaa Closes €4m Series-A

Summary

- Zadaa’s secondhand marketplace shakes up the C2C space with a fun and gamified shopping experience, packed with a revolutionary logistics solution making C2C shipping as cheap and hassle-free as shipping in the B2C world

- Lead investors included Begin Capital and Impulse VC, joined by existing investor Superhero Capital

- See Zadaa’s website and Instagram profile for additional product information

Full Story

Zadaa, a mobile-focused marketplace for consumers wanting to buy and sell secondhand apparel, has closed a €4M Series-A led by Begin Capital and Impulse VC, joined by existing investor Superhero Capital.

The marketplace, founded by 3 Finnish entrepreneurs with deep software development, gamification and B2B sales experience, has built a truly engaging shopping environment with a groundbreaking and highly scalable way of dealing with C2C logistics.

Zadaa’s 400,000+ customers are both loyal and active. 3.5 years after signing up, customers still purchase 60% of what they did in the sign-up month.

The gamified and addictive aspects of Zadaa’s shopping experience is illustrated by the company’s customer retention. Repeat purchases account for 84% of revenues. Among new users, 80% buy again on average within one week.

Zadaa’s success is further amplified by the global trend of buying second-hand, driven by the monetary and environmental benefits of re-using and re-cycling goods.

Zadaa is currently available in Finland, Denmark and Germany.

Zadaa’s key differentiators include:

- A game-changing logistics solution: Via its proprietary logistics API, used by DHL and others, Zadaa makes C2C shipping as cheap and simple as B2C shipping

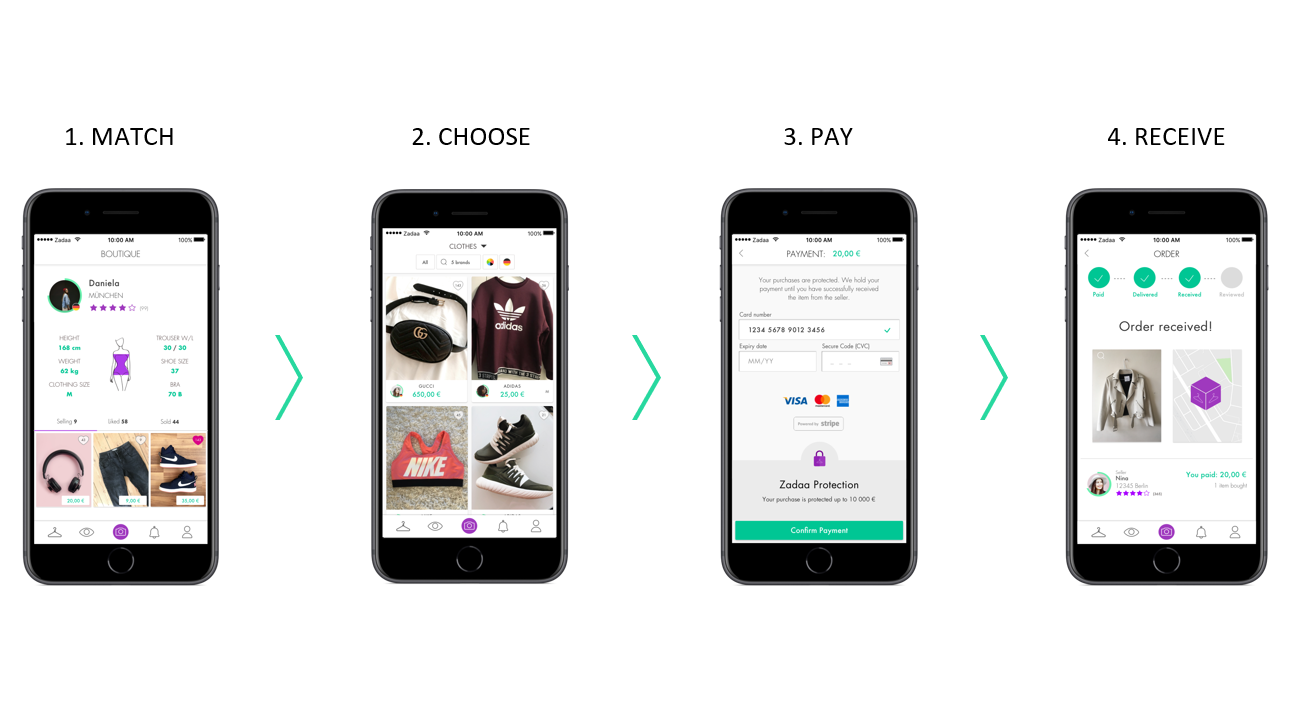

- Unparalleled matching & personalization: Zadaa’s deeply trained AI models know which items customers love and only suggests those that suit best

- Gamified UX: Zadaa’s mobile-only marketplace is filled with bleeding edge technology that make shopping fun, simple, social and highly engaging

Iiro Kormi, Zadaa’s CEO and Co-Founder, comments: “€4m in new funding will speed up Zadaa’s expansion to new markets and further secure its position as a leader in the secondhand marketplace segment. I am excited to welcome Begin Capital and Impulse VC who both have deep experience with C2C marketplaces and viral growth. Together we will capitalize on a significant global trend and bring the future of apparel shopping to customers across the globe.”

Impulse VC comments: “The secondhand clothing market is huge and grows faster than the new clothing market. In a relatively fragmented space, Zadaa clearly stands apart from its competitors with highly qualified founders, an advanced app, positive unit economics and a sophisticated logistics solution. We see a clear path for Zadaa to become the leader in the European secondhand consumer-to-consumer market and a reliable partner for enterprise customers in need of a logistics solution.”

Editor’s Note

For more information about this Press Release, contact: Iiro Kormi, iiro@zadaa.co

About Impulse VC

Impulse VC is a venture fund, founded in 2013, with a focus on IT-related companies. Its infrastructure is designed to support and raise strong technological teams. Impulse VC invests at late Seed and Series A stages in companies with the potential to scale their business models and open international markets. The fund's focus is on B2B SaaS, cloud solutions, marketplaces, marketing technologies, and e-commerce services. Impulse VC's portfolio includes more than 60 companies and $65m under management.

About nFront Ventures

nFront brings capital and operational support to companies across various stages of development. The core focus is on fast-growing, capital-efficient, software propositions in Europe and the U.S., raising between €1m and €20m. As its strategy, nFront helps companies prepare and execute strong fundraising rounds, before investing alongside leading VC funds and HNWs in its network. With 12 years of international VC experience, nFront brings in-depth industry knowledge and an active co-investor network of over 400 VCs and HNWs across Europe and the U.S.